Introduction –

As an ever-increasing number of organizations change to credit only instalment techniques and organizations themselves shift activities on the web or over portable cell phones, one of the key recipients will be the merchant account providers of these patterns. Merchant Services Agent/ISO selling merchant services will be at the front of profiting by these patterns. This vocation line will be compensating monetarily, set them up for proficient development, and have a feeling of achievement in a creative and quickly developing area. You can also look here for Selling Merchant Services. We should see the reason why being a Merchant Services Agent/ISO can be a fantastic open door as the business rapidly moves from being ferocious and duplicitous to continually developing advancement and cutting edge.

MSP Or ISO & Need for It –

A Merchant Services Agent, a Part Specialist co-op (MSP), otherwise called Independent Sales Organization (ISO), is utilized reciprocally inside the instalment/payment handling industry. As a merchant services agent, you are addressing a responsible bank to sell their instalment handling services. In any case, it is crucial for know that you would be expected to have forthright venture to be a piece of the bank’s affiliate program. In the meanwhile, you can look here for, How to Start a Credit Card Processing Company & know more. The advantages incorporate low purchase rates (the expense of the instalment handling administration which the ISO/MSP offers to merchants) and continuous help to help really market and give merchant account services. The downside of this ISO/MSP plan is the forthright venture expected to set up this relationship. Frequently, the responsible bank may not consider a singular merchant administration agent for the program, rather than expecting them to turn into a piece of a generally existing ISO/MSP.

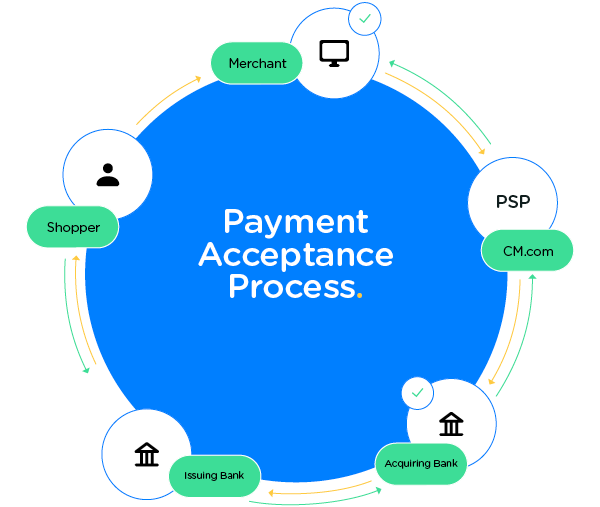

Working of Merchant Service Provider –

An option in contrast to being a merchant services agent/ISO is to work for one. Truly, the purchase rates will be higher since the MSP will keep their bonus to get a profit from their speculation of being a piece of the guarantor bank’s affiliate program. In any case, the recommendation is sufficiently rewarding to create a gain and kick you off in an industry, with extra assets for learning, direction, and likely leads. This without forthright expenses and setting out other open doors to work on your comprehension and get you out acquiring that a lot quicker. Learn on How to Become a Payment Processor in simple steps. Everything begins with a purchase rate. As the name recommends, the purchase rate is the rate at which you purchase the instalment handling administration from the ISO/MSP. This sum incorporates what the ISO/MSP gets and what the responsible bank gets. You will then add your own bonus to infer the instalment handling rate that is proposed to the merchant for the merchant account services.

Some Instances –

For instance, the purchase pace of the merchant services provider’s affiliate program that you are a piece of is 1.9% + $0.10, and you can offer it to merchants for 2.1% + $0.20. In this situation, your bonus will be 0.2% + $0.10. This probably won’t appear to be a lot, yet you procure on each card exchange a merchant process. On the off chance that a merchant processes 200 exchanges of a normal of $10 each, so $2,500, you procure 0.2% * $2500 = $5 + $0.10 * 200 = $20, so a sum of $25. That is $250 of month to month repeating pay assuming you join ten such merchants. You will keep on chipping away at your leads and hope to construct that number to represent your development projections and merchants leaving. The magnificence of this industry is that an ever-increasing number of organizations are beginning to take on credit only exchanges and portable instalment choices for convenience and speed. It’s exactly what the cell phone local purchasers request today.